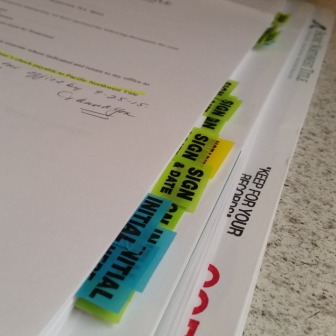

“E-closing” a mortgage is the next new development in the verification of documents, making the process faster and more convenient by using technology. Some credit unions are going paperless, making it possible for people to use an electronic process to close a mortgage remotely. The most important legal document in the closing, the mortgage repayment agreement, is signed in person, but all other documents are signed electronically and put on a USB.

“E-closing” a mortgage is the next new development in the verification of documents, making the process faster and more convenient by using technology. Some credit unions are going paperless, making it possible for people to use an electronic process to close a mortgage remotely. The most important legal document in the closing, the mortgage repayment agreement, is signed in person, but all other documents are signed electronically and put on a USB.

Borrowers like the e-closing process because documents are delivered earlier on average and they can view the documents before the closing, but the process can be a challenge for new lenders. Additionally, some states do not allow notaries public to approve documents electronically, but the increase in electronic borrowing processes aims to create a better, quicker system for borrowers and Notaries alike. The details are still being worked out, but the electronic closing of mortgages will become more widespread as lenders and notaries across the country adopt technology in their businesses.